The Role of Economic Factors in Traffic Planning and Selection of Lift Equipment

Rory S. Smith

University of Northampton

Northampton UK

This paper was presented at The 6th Symposium on Lift & Escalator Technology (CIBSE Lifts Group, The University of Northampton and LEIA) (2016). This web version © Peters Research Ltd 2018

Keywords: Traffic Planning, Equipment Selection, Net Present Value, Economics

Abstract. Traffic planning and lift equipment selection normally focuses on the quality and quantity of lift service. While these metrics continue to be of great importance, economic factors should also be considered when selecting lift equipment. The financial consequences of both over lifted and under lifted buildings are explored. Low cost low performance solutions are contrasted with high cost high performance systems. Simple financial engineering methods to evaluate equipment selection, such as Net Present Value analysis, are presented. The financial aspects of complex lift systems such as double deck, destination dispatch, and multiple cars in a single hoistway are explained.

1 INTRODUCTION

Traffic analysis focuses on Quantity of Service, usually expressed as Handling Capacity, and Quality of Service which is usually expressed as either Waiting Time or Interval. What is often assumed is a lift system that meets the design requirements for quantity and quality of service is also an economical solution. However, this may not always be the case.

2 ECONOMIC ANALYSIS

To understand how to define an economic solution one needs to review the economic factors that affect buildings.

2.1 Return on Investment

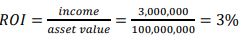

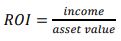

Buildings are assets and represent an investment in real estate. Investors are always interested in the return on their investment. Return On Investment (ROI) can be expressed as follows [1]:

In the case of buildings, income represents the rents collected from tenants minus operating expenses and asset value is the value of the lifts and all other building components. If an investor places €1,000 in a bank account and the bank pays the investor €30 per year in interest, then the investment has an ROI of 3%. If an investor builds a building for €100,000,000 and receives an income of €3,000,000 after all expenses, then the building investor also has an ROI of 3%. Applying Equation 1 to the building example yields the following results:

Three important factors that affect ROI in real estate investments are building cost, building lease rates, and building efficiency. Building cost establishes the asset value for determining ROI. Building lease rates are a major factor in determining income. Building efficiency, in this example is the percentage of gross building area that can be leased.

2.1.1 Under lifted buildings

An under lifted building will have a poor lift service. Chapter 3 of CIBSE Guide D provides guidance in the area of quality and quantity of service and what constitutes above and below average quality of service in various types of buildings [2]. An under lifted building will have below average service quality indicated by long waiting times and large queues.

In time, tenants will complain and eventually not renew their lease contracts. The building will get a bad reputation and the only way to attract tenants will be to offer reduced rents. Reduced rents and vacancies reduce income which in turn reduces ROI [4].

2.1.2 Over lifted buildings

Buildings with too many lifts will have great lift service. The asset value in the ROI equation will increase but the income will not increase. Tenants will not pay a premium for service that is better than needed. The higher asset value without an increase in income will reduce ROI. Additionally, the extra hoistway space reduces building efficiency.

2.1.3 Over lifted buildings

A building owner would like 100% of the building area to be leasable. This would equate to 100% efficiency. However, such things as electrical spaces, vertical Heating Ventilating and Air Conditioning (HVAC) ducts and lift hoistways cannot be occupied and therefore cannot be leased. It is for this reason that building owners want the lifts to occupy the least amount of floor space possible.

Example 1: A lift manufacturer offers 1000 kg, 1 m/s lifts in two sizes; 1100 mm wide by 2100mm deep and 1600mm wide by 1400mm deep [3]. The Hoistway area for the first size is 5.16 m² and 3.94 m² for the second size. The difference is 1.22 m² per lift per floor.

If 2 lifts with the smaller hoistways were installed in a 6 floor office building in Birmingham, UK where office rents are €463 per square meter per year [5], the building would receive €6,778 in additional income per year with no increase in costs.

If the building had 4 lifts and served 12 floors, then the increase in annual income would be €27,112.

In these examples, the asset cost did not increase but the income did increase. Therefore, ROI is increased. In evaluating competing lift designs that are otherwise equal, the one with the highest ROI should be selected.

2.2 Payback Period

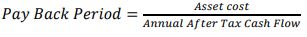

Another simple and conservative financial tool used to evaluate investment decisions is Payback Period [1]. This is a rule of thumb financial tool rather than a financial engineering tool and can easily be misapplied. The Payback period is the number of years required to recover the cost of the investment. Payback Period can be expressed as follows [1]:

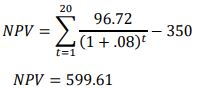

Example 2: Simulation has shown that a regenerative drive for a proposed 6 story building in Birmingham, UK will save €120.90 per lift per year based on a cost of €0.18/kWh [6]. The lift salesperson offers to provide regenerative drives for €350 each and advises the owner he will have a payback period of less than 3 years.

What the salesperson did not understand is the Payback Period method is based on after tax cash flow. If the building must pay a tax on profits of 20% [7], then the after tax cash flow is €120.90 x 0.8 or €96.72. Applying these values to Equation 2 yields a payback period that is now 3.6 years.

The Payback Period method does not consider the cash flows after the payback period. A better method for evaluating the desirability of an investment is the Net Present Value (NPV) method [1].

2.3 Net Present Value

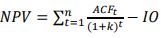

The NPV method considers the initial cash outlay, the desired return on investment, and the annual after tax cash flow over the life of the investment. NPV is calculated as follows [1]:

Where:

NVP represents Net Present Value

t represents time period

n represents the project’s life

ACF represents After tax Cash Flow

k represents required rate of return

IO represents Initial cash Outlay

The Time Value of Money describes the benefit of receiving money now rather than in the future [1]. A Euro today is worth more than a Euro a year from now because in normal times money deposited in a bank earns interest. Ninety three cents (€0.93) deposited in an account that pays 8% interest will be worth 1 Euro in a year. Therefore, the present value of a Euro collected one year from now is 93 cents.

The Net Present Value calculation converts future cash flows to today’s value. NPV is used to accept or reject an investment proposal. Since the NPV equation includes the minimum required rate of return, k, an NPV value of 0 or greater indicates that the investment delivers the required rate of return [1].

NPV can be applied to the decision to accept or reject the offer to pay an additional €350 for regenerative drives. The building developer requires a rate of return of 8%. Therefore, k will have a value of 0.08. The developer has determined that the economic life of the lifts is 20 years, giving n a value of 20.

Applying these values to equation 3 yields the following:

Since €599.61 is greater than 0, the offer should be accepted. Another way to look at this result is to add the NPV to the IO; this yields a value of €949.61. If the regenerative drives were offered for €949.61, the energy savings of €96.72 would have returned a NPV of 0, indicating that an investment of €949.61 would have yielded the required ROI of 8%.

Today there are several lift solutions that can reduce the building area required for lift shafts at additional initial cost. Many of these include more than one cabin per shaft such as double deck lifts and systems with 2 or more lifts per shaft. To evaluate the economic viability of one of these solutions one must calculate the increased rent income over the life of the building and use this to income to calculate the NPV of the increased IO.

Example 3, High Tech Lift:

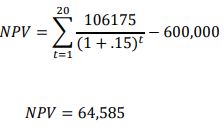

A proposed building in Birmingham, UK will be 18 storeys tall and will have 6 lifts rated at 1275 kg that will operate at 3 m/s. One lift provider has proposed a lift system that will only need the hoistway and lobby area of a 4 car group of lifts. However, this lift system will cost €600,000 more than a conventional 6 car group.

The developer likes the idea of the additional income but doesn’t like the additional cost. The lift company suggests a financial analysis of the proposed system using the NPV method.

Each of the hoistways is 2800mm x 2000mm. The original layout called for 3 lifts to be located on either side of a 3 meter wide lobby. Therefore, the area of the 2 lift shafts and the lobby that can be eliminated is 2800mm x 7000mm or 19.6 m² per floor. As there are 18 floors, the high tech system will increase the net leasable space by 352.8 m². Since rental rates in Birmingham are €463 per square meter per year, rental income will increase by €163,346.

Income and after tax cash flow are not the same. The developer estimates there will be administrative costs of 15% and corporate tax of 20%, which make the after tax cash flow €106,175.

The €600,000 cost of the high tech system was not budgeted. The developer must borrow the additional funds. For this reason he requires a rate of return of 15%. A portion of this 15% will be interest paid to the lender and the remaining portion will be his rate of return after interest expense.

The lift system is planned for a 20 year life.

The NPV calculation based on these values looks as follows:

Since the NPV is greater than 0 the proposal can be accepted.

Example 4: Modernization

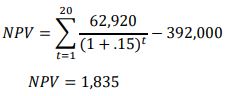

The management of an existing 12 storey building in Birmingham, UK is evaluating ways to improve the profitability of their building. The building is located in a prime location, is well maintained, but is 30 years old. The building is commanding rents that are 10% less than newer buildings. One of the building’s major detractors is the performance of its 4 lifts.

The building management believes with modernized lifts, rents could be raised from the current €417 per square meter to €430 per square meter. Rents for new buildings in the Birmingham area are €463 per square meter. The management believes that modernized lifts would also halt further erosion of their rental income.

The Building has 6,050 square meters of rental space above the lobby. The additional €13 per square meter would increase gross income by €78,650 (13 x 6050) per year. There will be no additional administrative costs associated with the increased income but there will be a 20% tax on this income. Therefore, the revenue after tax will be €62,920 (0.8 x 78,650).

A lift company has offered to modernize the 4 lifts for €98,000 each or €392,000 total.

The building management and their lift consultant decide to evaluate the economic feasibility of the lift modernization. They will use the NPV method and will assume a 20 year life and a rate of return of 15%. The rate of return was based on financing the modernization. The NPV based on these values appears as follows:

Since NPV is greater than 0, the modernization is economically feasible.

3 CONCLUSIONS

In the design of a lift system Quality and Quantity of Service are important. However, Economy is also important. Alternative proposals that cost more than a traditional design may in fact be more economical than a low cost design.

Understanding the time value of money, the concepts of Return On Investment and Payback Period, as well as the use of financial engineering tools such as Net Present Value can help the lift professional to present solutions that are more economical than those solutions developed without considering economy.

REFERENCES

- Martin et al, Basic Financial Management. Prentice Hall, Englewood Cliffs, (1991).

- CIBSE, CIBSE Guide D: Transportation systems in buildings. The Chartered Institution of Building Services Engineers (2015).

- Kone Design Collection Monospace 700 Available from: http://cdn.kone.com/www.kone.co.uk/Images/MonoSpace_700_Design_book.pdf?v=4 Last accessed: 26 May, 2016

- Rory Smith, “Underlifted Buildings in the Middle East” Symposium on Lift and Escalator Technologies (2014)

- Cushman & Wakefield United Kingdom Office Market Snapshot Q1 2016 Available from: http://www.cushmanwakefield.com/en/research-and-insight/uk/united-kingdom-office-snapshot/ Last accessed: 25 May, 2016

- Electricity Pricing Available from: https://en.wikipedia.org/wiki/Electricity_pricing Last accessed: 24 May, 2016

- List of countries by tax rates Available from: https://en.wikipedia.org/wiki/List_of_countries_by_tax_rates Last accessed 25 May, 2016

BIOGRAPHICAL DETAILS

EUR ING Dr. Rory Smith is Visiting Professor in Lift Technology at the University of Northampton. He has over 47 years of lift industry experience and has been awarded numerous patents.